Author:

Keefer Taylor, Hover Labs [email protected]

Created:

04/08/2021

Status:

DRAFT

Summary

Sets economic parameters in which we’d consider lowering the stability fee based on economic data.

Motivation

Kolibri’s stability fee (the rate charged to borrowers) is currently 22%. While this has helped keep peg stable, the high rate may be hindering the growth and adoption of Kolibri.

In the early days of kUSD there was nothing to do with the asset besides sell it for XTZ. This effectively meant kUSD minters could take long positions on the price of XTZ. The other use case available to minters were peer to peer transactions of kUSD and holding kUSD to liquidate ovens. Demand for long positions greatly outstripped other use cases, and our initial fee raise proposal continuously raised the stability fee until peg was achieved.

Since the early days, several new use cases for kUSD have emerged:

-

Liquidity Providing on Quipuswap: Earn fees by providing liquidity; Currently ~$1.3M

kUSDare locked -

Kolibri Liquidity Pool: Pool money to help liquidate undercollateralized ovens; Currently ~$680k

kUSDare locked -

Kolibri Farms: Stake your

kUSDto receivekDAO; currently +$1.5MkUSDlocked -

Crunchy Farms: Stake your

kUSDto receivecrDAO; currently ~$340kkUSDlocked -

Rocket Launchpad: Will accept

kUSDin their upcoming token sale

We also anticipate new products coming online, specifically:

-

sexp: Trustless binary options settled in

kUSD - Additional Decentralized Exchanges, notably SpicySwap and Plenty Finance, where users can provie liquidity

- Lending platforms that will provide return on lending kUSD (Specifically Tezos.Finance and Yupana and Hera). Hover Labs has also stated that we may want to launch a

kUSDlending platform - Upon activation of the Tezos Granada Protocol (~48 hours from now), Kolibri farms will return double with the increased block time.

These additional use cases give folks reasons to have reason to want to balance out the adoption of kUSD, however, the high stability fee may be limiting demand for these use cases.

Details

As in our initial fee raising proposal, we propose lowering the stability fee according to an exponentially weighted moving average of the last 10 hours.

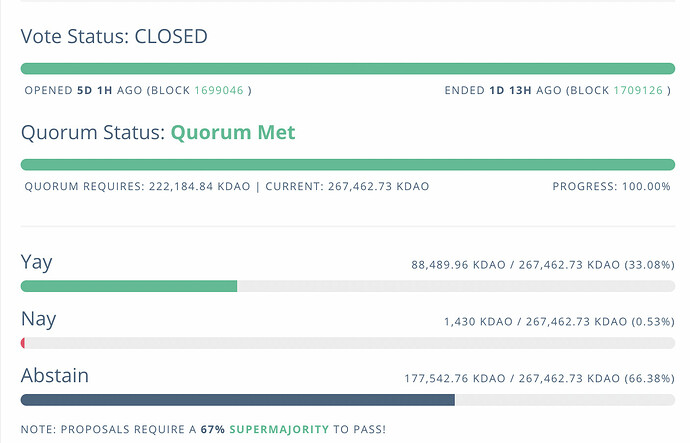

During our initial fee raising proposal, adjustments were done via a multisig with an 8 hour timelock, which allowed fine-grained, frequent, adjustments. Now that Kolibri is governed by Kolibri DAO, proposals will take 6 days to pass (3 days voting, 3 days timelock). This means that criteria for lowering the stability fee may need to be forward looking, and may need to be cancelled if passed.

I propose the following set of criteria:

- When the EMA10 of the Quipuswap Kolibri Peg (as determined by Kolibri Stats) remains below 1.5%

- Then the stability fee can be cut by up to 2.5%

- If, during the period of voting and timelock, the EMA10 of the Quipuswap Kolibri Peg (as determined by Kolibri Stats) reaches above +2%, Hover Labs will commit to cancelling the proposal

- Any additional DEXes that come online during the next 30 days will be disregarded, since liquidity may be low and prices therefore volatile

This set of criteria affords us several benefits;

- Small Cut: A small cut to the fee is unlikely to massively destabilize the protocol, and provides additional data

-

Forward Looking: A down trend to -.5% indicates a direction of the

kUSDpeg where we could begin voting -

Reversible: If, during voting, peg destabilizes then the proposal is always cancellable. If

kUSDfails to hold peg at 20% stability fee, we can always submit n additional proposal.