Author:

Ryan Sears [email protected]

Created:

11/07/2021

Status:

PROPOSED

Summary

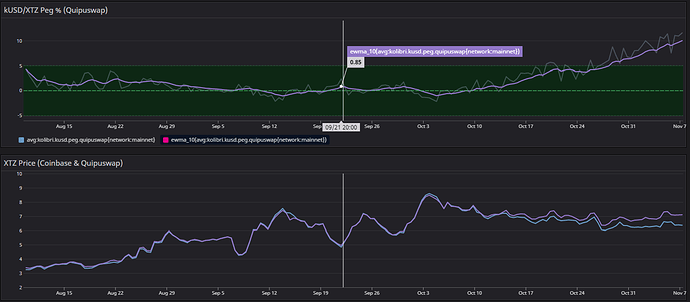

The Kolibri peg has been off for the past couple weeks to the point where intervention seems to have become necessary to get the peg back on-track.

The underlying price of $XTZ has been slowly dipping/trading flat, so that (along with the price of $XTZ doubling in the past few months, creating more un-used collateralization usage) is likely the catalyst for larger ovens to exert sell pressure on kUSD to presumably go long on the underlying $XTZ, which has been pushing the price down to ~$0.90.

Motivation

Kolibri’s first purpose is to remain a stable store of value. With low liquidity across the entire Tezos DeFi ecosystem, this is a hard thing to maintain given that even modest sized transactions have a significant price impact on $kUSD, so when larger trades are happening for extended periods of time, it can blow the peg out of balance.

Details

The chart above is the past 3 months of statistics for the Kolibri Protocol, and the line indicates where KIP-002 went was passed by the DAO.

As you can see, the peg remained within ideal ranges (the green area is +/- 5%) while the underlying price of $XTZ was climbing, but as it’s been tapering off/slowly dwindling, an uncoupling of prices between Harbinger and Quipuswap kUSD/XTZ has been happening.

In order to help relieve some of the buy-side pressure that’s happening, this proposal suggests a stability fee increase of 2%, from the current 19.5% to 21.5%.